Choosing between the freelance lifestyle and becoming a business owner is a pivotal decision for anyone seeking professional autonomy. This article explores the key differences between being a freelancer and a business owner, helping you determine which path aligns with your career goals, financial aspirations, and overall work-life balance preferences. We’ll delve into the core aspects of each path, weighing the pros and cons of freelancing versus business ownership, enabling you to make an informed decision that sets you on the right course for success.

Are you drawn to the flexibility of freelancing or the scalability of building a business? Understanding the distinct characteristics of each model is crucial. This article examines the advantages and disadvantages of both freelancing and business ownership. From managing finances and acquiring clients to long-term growth potential and risk tolerance, we’ll cover the essential elements to consider when choosing between a freelance career and the journey of entrepreneurship. By the end, you’ll have a clearer understanding of which path better suits your individual needs and professional ambitions, allowing you to embark on your chosen path with confidence.

Key Differences Between the Two

While both freelancers and business owners work independently, there are key distinctions.

Freelancers typically work on a project-by-project basis for multiple clients, offering specialized skills. Their focus is on delivering individual services. They have less control over their workload and income stability compared to business owners.

Business owners, on the other hand, operate their own businesses, often with the goal of scaling and growth. They might hire employees, manage multiple projects simultaneously, and focus on building a brand and a long-term enterprise. They have greater control over their direction and income potential but also bear more responsibility.

Pros and Cons of Freelancing

Freelancing offers appealing advantages, such as flexibility in scheduling and location, and the autonomy to choose projects. It also allows for skill diversification and the potential for higher earning based on project rates.

However, freelancing comes with drawbacks. Income instability is common, with no guaranteed regular paycheck. Freelancers are responsible for their own self-employment taxes and benefits like health insurance. Finding clients and managing workflow can also be challenging. Isolation can also be a factor, lacking the social interaction of a traditional workplace.

Pros and Cons of Building a Business

Building a business offers significant potential rewards but also comes with inherent challenges. Pros often include greater control over your work, higher earning potential through scaling, and the satisfaction of building something from the ground up. Building a brand and leaving a legacy are also motivating factors for many.

However, the cons can be substantial. Starting a business requires significant capital investment, involves greater risk, and demands more time and responsibility. The initial stages often involve long hours, unpredictable income, and the pressure of managing multiple aspects of the business, from operations and marketing to finances and legal compliance.

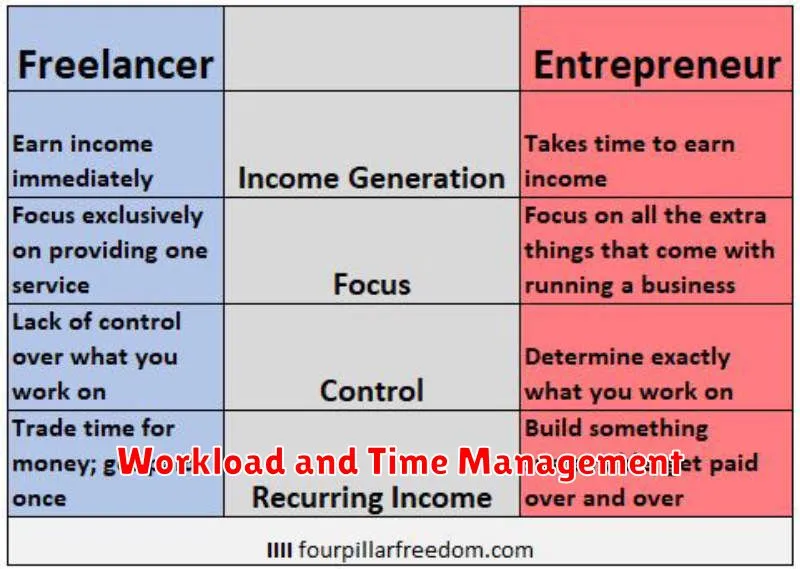

Workload and Time Management

A key difference between freelancing and business ownership lies in workload and time management. Freelancers typically have more control over their daily schedule, choosing which projects to accept and when to work. This flexibility can be appealing, but it also requires strong self-discipline to manage time effectively and meet deadlines.

Business owners, on the other hand, often juggle multiple responsibilities, from managing employees and finances to overseeing operations and marketing. This can lead to a heavier workload and longer hours, particularly in the early stages of building a business. While demanding, this offers greater potential for long-term growth and scalability.

Financial Growth Potential

A key difference between freelancing and business ownership lies in financial growth potential. Freelancers generally earn based on their billable hours or project fees, creating a direct link between time invested and income earned. This model can limit earning potential, as there are only so many hours in a day.

Business owners, however, have the potential for exponential growth. By building a team and developing scalable systems, they can generate revenue beyond their individual capacity. Profits are not solely reliant on the owner’s direct work, offering significantly higher earning potential in the long run.

Brand Building and Client Retention

A key distinction between freelancers and business owners lies in their approach to brand building and client retention. Freelancers often focus on project-based work, marketing their individual skills. Client relationships may be transactional, ending upon project completion.

Business owners, conversely, invest in building a recognizable brand. This involves developing a unique brand identity, voice, and online presence. They prioritize long-term client relationships, nurturing connections and fostering loyalty. This focus on retention creates a stable client base, leading to predictable revenue streams and sustained growth.

Legal and Tax Considerations

Legal structure significantly impacts your liabilities and taxes. Freelancers often operate as sole proprietors, bearing personal liability for business debts. Forming an LLC or S-corp provides liability protection, separating personal and business assets.

Tax obligations also differ. Freelancers pay self-employment taxes (covering Social Security and Medicare) in addition to income tax. Business owners, depending on their structure, might have different tax requirements, potentially deducting business expenses and utilizing various tax strategies. Consulting with a legal and tax professional is crucial to understanding the implications of each path.

Lifestyle and Flexibility Differences

A primary distinction between freelancing and business ownership lies in lifestyle and flexibility. Freelancers often enjoy greater control over their schedules, choosing when and where to work. This autonomy allows for a better work-life balance for some, accommodating personal appointments or family commitments more easily.

Business owners, however, frequently experience less flexibility, especially in the early stages. Building and managing a business demands significant time and dedication, often requiring longer hours and a less predictable schedule. While ownership offers the potential for greater long-term flexibility and scaling back later, the initial phase typically involves significant commitment.

When to Make the Switch

Transitioning from freelancer to business owner is a significant step. There’s no single “right” time, but recognizing key indicators can help you make an informed decision. Consider making the switch when your freelance work consistently exceeds your capacity to handle it alone. This often manifests as a full client roster and a consistent need to turn down projects.

Another strong indicator is the desire to scale your operations and increase your earning potential beyond the limits of individual client work. If you find yourself regularly envisioning a larger team or broader service offerings, it might be time to formalize your business structure. Finally, a strong desire for more autonomy and control over your long-term vision can signal readiness for business ownership.

Planning for Long-Term Success

Whether you choose the freelancer or business owner path, long-term success requires planning. Freelancers should focus on building a strong portfolio, diversifying their client base, and consistently upskilling to remain competitive. This might involve setting income goals, investing in marketing, and developing a niche expertise.

Business owners, on the other hand, need a comprehensive business plan that addresses market analysis, financial projections, and operational strategies. Scalability is a key consideration, requiring careful planning for team building, process development, and potential expansion. Long-term success as a business owner involves building a sustainable brand and establishing reliable revenue streams.