Effectively tracking business expenses is crucial for financial health and informed decision-making. Understanding where your money is going allows you to identify areas for cost savings, maximize profitability, and ensure accurate financial reporting. This comprehensive guide will outline practical strategies and tools to efficiently track your business expenses, simplifying the process and empowering you to take control of your finances. Whether you’re a small business owner, freelancer, or entrepreneur, implementing these techniques will contribute significantly to your long-term success.

From simple spreadsheet methods to sophisticated software solutions, we will explore various approaches to expense tracking that cater to different business needs and budgets. Learn how to categorize expenses effectively, establish consistent tracking habits, and leverage technology to automate the process. By mastering efficient business expense tracking, you’ll gain valuable insights into your financial performance and position yourself for sustainable growth. Discover how to streamline your expense management and free up valuable time to focus on other critical aspects of your business.

Why Expense Tracking Is Crucial

Expense tracking is paramount for maintaining a healthy financial overview of your business. It provides essential insights into where your money is going, allowing for informed financial decisions.

Accurately tracking expenses enables you to identify areas of overspending and implement cost-saving measures. This can significantly impact profitability and contribute to the long-term financial stability of your business.

Furthermore, meticulous expense records are crucial for tax purposes. Having organized documentation simplifies tax preparation, ensures compliance, and can potentially lead to valuable deductions, minimizing your tax liability.

Manual vs Automated Tracking

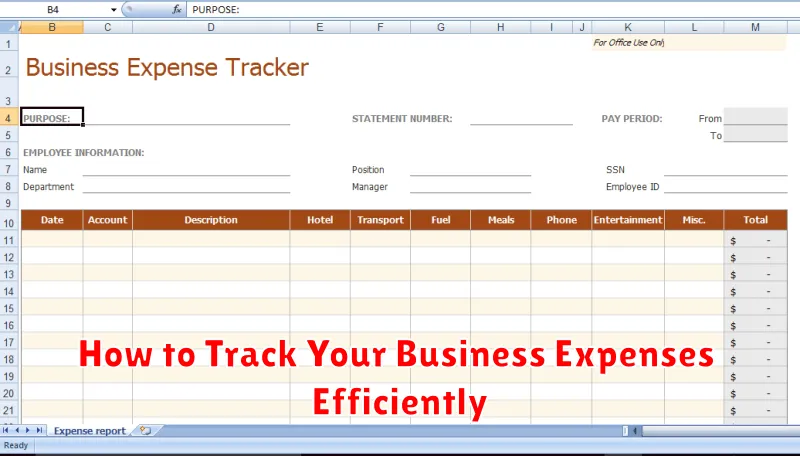

Choosing between manual and automated expense tracking depends largely on the size and complexity of your business. Manual tracking, often using spreadsheets, is suitable for very small businesses with minimal transactions. However, it’s time-consuming and prone to human error.

Automated tracking, through dedicated software or apps, offers significant advantages as your business grows. It streamlines data entry, minimizes errors, and provides real-time insights into your spending. Automation also facilitates generating reports for tax purposes and financial analysis.

Using Apps for Receipt Management

Leveraging technology can significantly improve receipt management. Numerous apps are designed specifically for this purpose, offering features that streamline the process and reduce manual effort. These apps often utilize Optical Character Recognition (OCR) to automatically extract key data from receipts, such as date, vendor, and amount. This eliminates the need for manual data entry, saving time and reducing errors.

Many receipt management apps also offer cloud storage, ensuring your receipts are securely backed up and accessible from anywhere. This is particularly useful for tax season or audits, as you can easily search and retrieve receipts based on various criteria. Furthermore, some apps integrate with accounting software, enabling seamless transfer of expense data and further simplifying your financial management.

Categorizing Business Costs Properly

Proper cost categorization is essential for efficient expense tracking. Accurate categorization allows for insightful analysis of spending, informed decision-making, and simplified tax preparation.

Establish clear and consistent categories relevant to your business. Common categories include Cost of Goods Sold (COGS), operating expenses (rent, salaries, marketing), and capital expenditures. Subcategories can provide further granularity. For example, within operating expenses, you might have subcategories for office supplies, utilities, and travel.

Consistently applying these categories to every expense ensures accurate reporting and analysis. Use accounting software or spreadsheets to facilitate categorization and tracking.

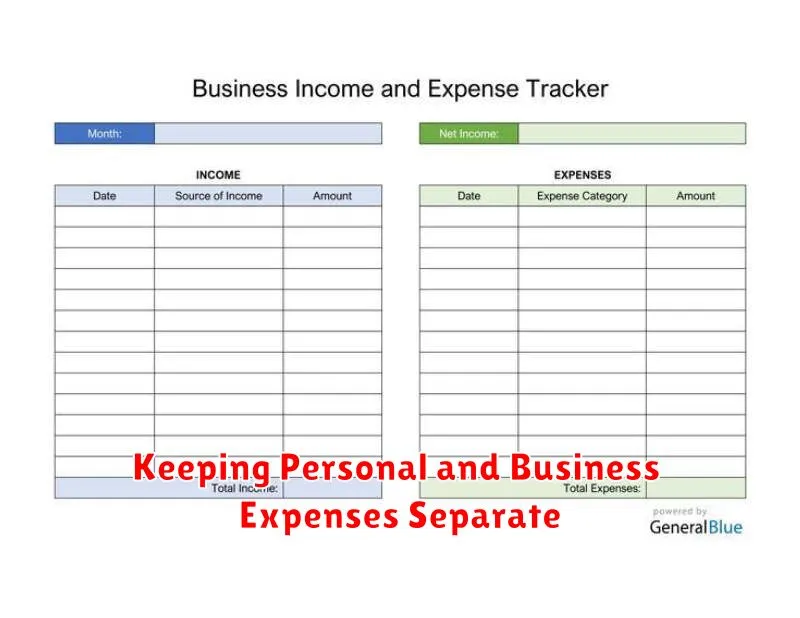

Keeping Personal and Business Expenses Separate

Maintaining separate accounts for personal and business finances is crucial for accurate expense tracking and simplified tax preparation. Commingling funds can lead to confusion, making it difficult to identify deductible business expenses and potentially triggering IRS scrutiny.

Open a dedicated business bank account and obtain a business credit card. This provides a clear delineation between personal and business transactions. Consistently use the business accounts for all business-related expenses, no matter how small.

Monthly Review and Reconciliation

Monthly review and reconciliation is a crucial step in effectively tracking business expenses. This process allows you to identify any discrepancies or errors, ensuring accurate financial records.

Start by comparing your recorded expenses against your bank statements and credit card statements. Look for any transactions that might have been missed or entered incorrectly. This is also a good time to categorize any uncategorized expenses.

Reconciling your expenses monthly helps to catch errors early, making them easier to correct. It also provides a clear overview of your spending, supporting better budget management and financial planning.

Handling Recurring Payments

Recurring payments, such as subscriptions and rent, require a systematic approach to avoid missed payments and maintain accurate expense records. Automating these payments is a highly effective strategy.

Set up automatic payments through your bank or the vendor’s platform. This ensures timely payments and reduces administrative overhead. Maintain a spreadsheet or utilize expense tracking software to log these recurring transactions. Categorize each payment appropriately for easier analysis and reporting.

Regularly review your recurring payments. This allows you to identify any price changes, unwanted subscriptions, or services you no longer require. Proactively managing recurring payments will streamline your expense tracking and help maintain a healthy budget.

Integrating with Accounting Software

Integrating your expense tracking system with your accounting software is crucial for streamlined financial management. This integration eliminates manual data entry, reducing errors and saving valuable time.

Most modern accounting software solutions offer seamless integration with various expense tracking apps. This connection allows expense data to flow automatically into your accounting system, simplifying reconciliation and reporting.

Key benefits include improved accuracy, increased efficiency, and better financial oversight. By automating data transfer, you can focus on analyzing your spending patterns and making informed business decisions.

Creating Reports for Budgeting

Generating regular reports is crucial for effective budget management. These reports provide insights into your spending patterns and help identify areas for potential savings. Accurate and timely reports are essential for making informed financial decisions.

Consider using budgeting software or spreadsheet programs to create customized reports. These tools allow you to track expenses by category, compare actual spending to budgeted amounts, and visualize trends over time.

Key reports to consider include:

- Profit & Loss Statement: Provides an overview of revenue, expenses, and net income.

- Cash Flow Statement: Tracks the movement of cash in and out of your business.

- Expense Reports by Category: Detailed breakdown of spending in specific areas (e.g., marketing, rent, salaries).

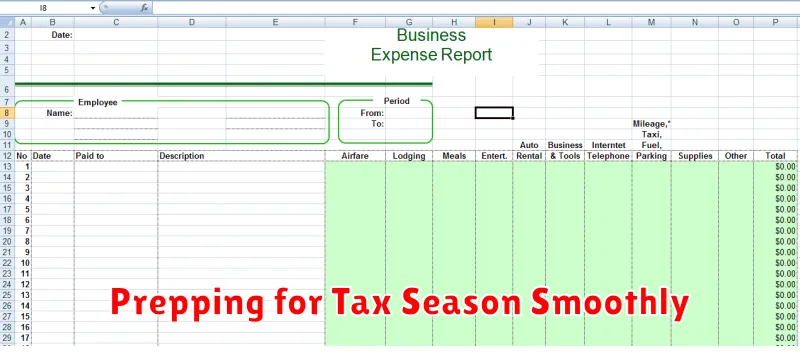

Prepping for Tax Season Smoothly

Efficient expense tracking throughout the year significantly simplifies tax preparation. By staying organized, you’ll avoid the last-minute scramble and potential stress associated with gathering financial information.

Key steps for a smooth tax season include categorizing expenses meticulously, utilizing accounting software or spreadsheets, and retaining all necessary receipts and invoices. This organized approach enables you to readily generate essential financial reports, like profit and loss statements, for your tax filings.

Consider consulting with a tax professional. They can provide valuable insights tailored to your business, ensuring compliance and potentially identifying tax-saving opportunities you might overlook.