Choosing the right business bank account is a crucial step for any entrepreneur, freelancer, or established company. The right account can streamline your business finances, simplify money management, and help you achieve your financial goals. Navigating the numerous options available can be challenging, however. This guide will provide you with a comprehensive overview of the essential factors to consider when selecting a business bank account that best suits your specific needs. We’ll cover everything from account fees and transaction limits to online banking features and customer support, empowering you to make an informed decision and choose the perfect financial partner for your business.

Whether you’re just starting a small business or managing a large corporation, understanding the nuances of business banking is essential for success. This article will explore the different types of business bank accounts available, including checking accounts, savings accounts, and merchant services. We’ll delve into the benefits and drawbacks of each, taking into account factors such as minimum balance requirements, interest rates, and transaction fees. By the end of this guide, you will be equipped with the knowledge necessary to confidently select the best business bank account to optimize your financial operations and support your business growth.

Why a Separate Business Account Matters

Maintaining a distinct business bank account is crucial for several reasons. It primarily provides a clear separation between your personal and business finances, simplifying accounting and protecting your personal assets. This separation is essential for tax purposes, making it easier to track income and expenses, and potentially reducing your tax burden.

Additionally, a separate business account enhances your professional image, lending credibility and fostering trust with clients and vendors. It also simplifies financial management, allowing for easier tracking of business performance and cash flow.

Checking vs Savings for Businesses

Choosing between a checking and savings account is a crucial step in managing business finances. Checking accounts are designed for frequent transactions. They offer easy access to funds through checks, debit cards, and online transfers, making them ideal for daily operational expenses like paying bills and suppliers. Checking accounts typically earn little to no interest.

Savings accounts, conversely, are intended for accumulating funds. While they offer limited transaction capabilities, they earn a higher interest rate than checking accounts. This makes them suitable for storing reserve funds, emergency funds, or money earmarked for future investments.

Many businesses utilize both checking and savings accounts to optimize their financial management.

Monthly Fees and Transaction Limits

Monthly fees are a common feature of business bank accounts. These fees can vary significantly between banks and account types. Some banks offer accounts with no monthly fee, while others may charge a substantial amount. Carefully consider your expected transaction volume and account balance to determine if a monthly fee is justified.

Transaction limits restrict the number of transactions you can perform each month, such as deposits, withdrawals, and transfers. Exceeding these limits can result in additional fees. Review the transaction limits for each account and choose one that aligns with your business needs. Some accounts offer unlimited transactions, often for a higher monthly fee.

Online Banking Features to Look For

When selecting a business bank account, robust online banking features are crucial for efficient financial management. Look for accounts offering real-time account balances and transaction history. This provides immediate insight into your finances.

Online bill pay is another essential feature, allowing you to schedule and manage payments electronically, saving time and reducing the risk of late fees. Consider whether the platform offers mobile access, enabling you to manage your account from anywhere.

Finally, investigate the availability of account alerts. These notifications can inform you of important events, like low balances or suspicious activity, helping you stay on top of your finances and maintain security.

Integration With Accounting Software

Seamless integration with your accounting software is a critical factor to consider when choosing a business bank account. This integration can significantly streamline your financial management processes.

Direct integration allows for automatic transaction imports, reducing manual data entry and the risk of errors. Look for accounts that are compatible with popular accounting software packages. This compatibility will save you time and improve the accuracy of your financial records.

Consider whether the integration offers real-time updates or if it’s a batch process. Real-time updates provide a more current view of your finances. Also, investigate the depth of integration. Some integrations may only import basic transaction data, while others offer more comprehensive features such as automatic reconciliation.

Ease of Deposits and Transfers

Convenient deposit and transfer options are crucial for managing business finances efficiently. Consider how frequently you’ll be making deposits and the methods you’ll use. Does the bank offer mobile check deposit, ATM deposits, or night drop services?

Evaluate the transfer capabilities. Can you easily transfer funds between accounts, make ACH payments, or send wire transfers? Look for features like online banking and mobile banking apps that streamline these processes. A bank that aligns with your business’s deposit and transfer needs will save you time and effort.

Card Access and User Management

Control over card access and user permissions is crucial for managing business finances effectively. Consider how many debit cards you require and whether you need to set different spending limits for each card. Some banks offer virtual cards for added security for online transactions.

User management features are equally important, especially for businesses with multiple employees handling finances. Look for accounts that allow you to assign different roles and permissions to users. This enables you to control who can access account information, initiate transactions, and approve payments.

Mobile App Functionality

In today’s fast-paced business environment, convenient access to your business finances is crucial. A robust mobile banking app allows you to manage your account from virtually anywhere. Consider the following functionalities when evaluating a business bank account:

- Mobile Check Deposit: The ability to deposit checks using your phone’s camera can save valuable time and trips to the bank.

- Funds Transfers: Easily transfer funds between accounts or make payments to vendors on the go.

- Account Balance Monitoring: Real-time access to your account balance helps you stay informed and avoid overdrafts.

- Transaction History: Reviewing recent transactions can be essential for tracking expenses and managing cash flow.

- Alert Notifications: Customize alerts for low balances, deposits, and other important account activities.

Carefully assess your business needs and prioritize the mobile functionalities that will streamline your financial management.

Choosing Based on Business Size

Your business size significantly impacts your banking needs. Small businesses and startups often benefit from accounts with lower fees and minimum balance requirements. As your business grows, consider accounts offering more complex features.

Mid-sized businesses typically require accounts with higher transaction limits, more sophisticated cash management tools, and potentially lines of credit. Look for features such as multiple user access and integration with accounting software.

Large corporations often require dedicated relationship managers, complex treasury management services, and customized solutions to meet their specific financial needs. Prioritize banks with a proven track record of serving large enterprises and offering specialized financial products.

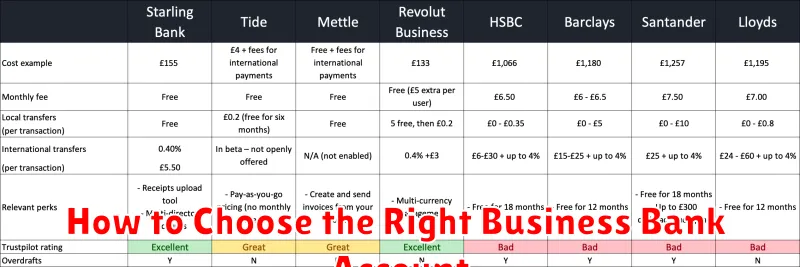

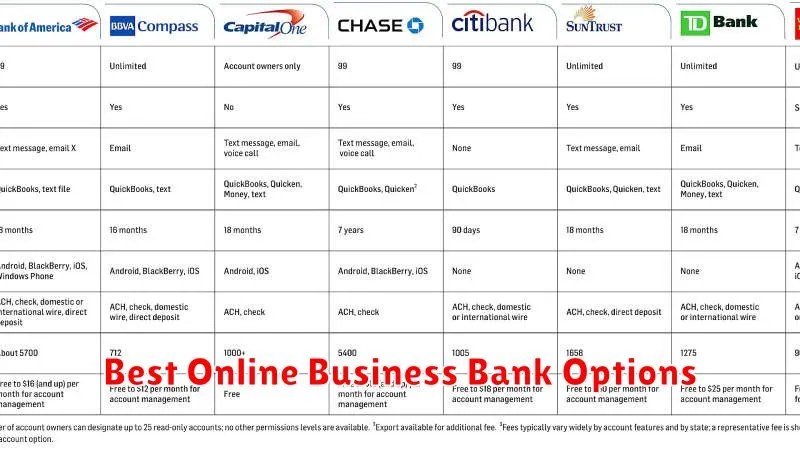

Best Online Business Bank Options

Choosing the right online business bank can significantly impact your financial operations. Factors like fees, account features, and customer support should be carefully considered.

Below are some of the best options available, catering to various business needs:

| Bank | Key Features |

|---|---|

| Bank A | No monthly fees, unlimited transactions, mobile check deposit |

| Bank B | Integration with accounting software, strong customer support, multiple account types |

| Bank C | High interest rates on balances, robust online banking platform, dedicated business advisors |

Remember to research each bank thoroughly to determine which best aligns with your specific requirements.