Navigating the world of business taxes can be daunting for new entrepreneurs. This beginner’s guide provides a comprehensive overview of business tax fundamentals, helping you understand the various tax obligations, deductions, and credits relevant to your business. Whether you’re a sole proprietor, forming a partnership, or incorporating an LLC or corporation, understanding the tax implications is crucial for success. This guide will clarify complex tax laws and provide essential information to ensure tax compliance and minimize your tax liability.

From estimated taxes and self-employment tax to corporate income tax and sales tax, this guide breaks down the key tax types that may apply to your business. We’ll explore the different tax forms, deadlines, and reporting requirements. Learn how to effectively manage your business finances related to taxation, including record-keeping best practices. By gaining a solid understanding of business taxes, you can avoid costly penalties and optimize your financial strategy for long-term growth.

The Basics of Business Tax Types

Navigating the world of business taxes can seem daunting, but understanding the basic types is a crucial first step. Different business structures face varying tax obligations. The most common types include income tax, self-employment tax, employment tax, and excise tax.

Income tax is levied on the profits earned by a business. Self-employment tax covers Social Security and Medicare taxes for individuals working for themselves. Businesses with employees must pay employment taxes, which also contribute to Social Security and Medicare, as well as unemployment insurance. Excise taxes are imposed on specific goods or services, such as gasoline or alcohol, and are usually included in the price consumers pay.

Federal vs State Tax Obligations

Navigating the tax landscape as a business owner requires understanding both federal and state tax obligations. Federal taxes are levied by the Internal Revenue Service (IRS) and apply to all businesses operating within the United States. These taxes fund nationwide programs and services.

State taxes, on the other hand, vary depending on the state where your business is located or operates. Each state has its own set of tax laws and regulations. These taxes support state-specific initiatives and infrastructure.

Understanding the differences and meeting both federal and state requirements is crucial for legal compliance and financial stability.

Estimated Quarterly Payments

If you expect to owe $1,000 or more in taxes, you’ll likely need to make estimated tax payments each quarter. This applies to various taxes, including income tax, self-employment tax, and others.

These payments are typically due on the 15th of April, June, September, and January. Failing to pay on time can result in penalties. Use Form 1040-ES, Estimated Tax for Individuals, to calculate and pay these taxes.

Several factors influence the amount you owe, such as your income, deductions, and credits. It’s advisable to consult with a tax professional or use reputable tax software to ensure accurate calculations.

Sales Tax Collection and Remittance

Sales tax is a consumption tax imposed on the sale of goods and services at the state and local levels. As a business owner, you might be required to collect sales tax from your customers. This responsibility hinges on your nexus, or significant presence, within a specific jurisdiction.

If you have nexus, you must register with the relevant tax authority, obtain a sales tax permit, and begin collecting the appropriate tax rate. This rate varies by location and is based on the destination of the sale or the origin, depending on state laws.

Collected sales tax is not your business’s money; it’s held in trust until remitted to the tax authority by the designated due date. Remittance is the process of filing a sales tax return and paying the collected tax. Failure to remit collected sales tax can result in penalties and interest.

Self-Employment Tax Considerations

Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes, commonly referred to as self-employment tax. This is because they are both the employer and the employee.

The self-employment tax rate is 15.3%. This comprises 12.4% for Social Security and 2.9% for Medicare. You calculate this tax on your net earnings from self-employment, after deducting allowable business expenses.

An important consideration is the deduction for one-half of self-employment tax. While you are responsible for both halves of the tax, you can deduct one-half of the amount you pay when calculating your income tax liability. This helps to offset the higher tax burden faced by self-employed individuals.

Tax Deductions and Write-Offs

Tax deductions and write-offs are essential aspects of managing your business finances. They reduce your taxable income, which, in turn, lowers your overall tax liability. Understanding which expenses qualify can significantly impact your bottom line.

A tax deduction lowers your taxable income by reducing your gross income. Common examples include rent, salaries, and office supplies. A write-off is a deduction that accounts for the decrease in value of an asset over time, such as depreciation on equipment. Both ultimately reduce the amount of income you are taxed on.

Keep accurate records of all your business expenses. This documentation is crucial for substantiating your deductions during tax season and avoiding potential issues with the IRS.

Filing Deadlines and Forms

Meeting tax deadlines is crucial to avoid penalties. Different business structures have varying deadlines. Sole proprietorships and single-member LLCs typically file by April 15th. Partnerships and S corporations usually file by March 15th. Corporations often have different deadlines depending on their fiscal year.

The forms you need depend on your business structure and income. Common forms include: Form 1040 (for sole proprietors, single-member LLCs), Form 1065 (for partnerships), Form 1120-S (for S corporations), and Form 1120 (for corporations). Consult a tax professional to ensure you’re using the correct forms.

Hiring an Accountant vs DIY Filing

Choosing between hiring an accountant and doing your own taxes is a crucial decision for any business owner. Cost, complexity, and time commitment are key factors to consider.

DIY filing can save money, but requires a thorough understanding of tax laws. It’s a good option for businesses with straightforward finances.

Hiring an accountant offers expertise and can help minimize errors and maximize deductions. This is often preferable for businesses with complex finances or those lacking the time to dedicate to tax preparation.

Bookkeeping Best Practices

Accurate and organized bookkeeping is essential for managing your business finances and navigating tax season successfully. By following some key practices, you can streamline the process and ensure compliance.

Separate Business and Personal Finances: Open a dedicated business bank account and credit card to clearly distinguish between personal and business transactions. This simplifies tracking income and expenses, making tax preparation much easier.

Track Everything: Keep detailed records of all income and expenses. Utilize accounting software or spreadsheets to categorize transactions and generate reports. Retain receipts and invoices to substantiate your records.

Reconcile Regularly: Reconcile your bank and credit card statements monthly against your bookkeeping records. This helps identify discrepancies early on and ensures accurate financial reporting.

Categorize Transactions: Properly categorize all income and expenses to gain insights into your business performance and simplify tax reporting. Use a chart of accounts to standardize your categorization.

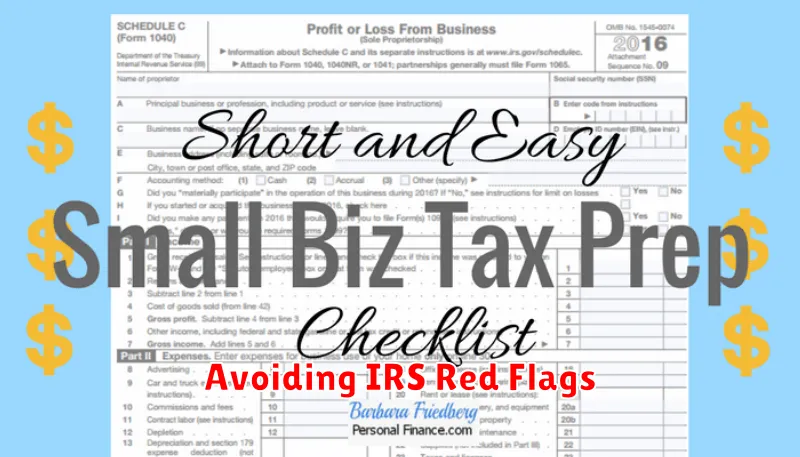

Avoiding IRS Red Flags

Accurate and timely filing is crucial to avoid unwanted attention from the IRS. Failing to file or filing late are major red flags. Keep meticulous records of all income and expenses. This includes invoices, receipts, and bank statements. Disorganized or incomplete records can trigger an audit.

Claiming excessive deductions is another common issue. Ensure all deductions are legitimate and substantiated with proper documentation. Overstating expenses or underreporting income can also raise red flags. Be honest and accurate in all your filings.

Inconsistencies between reported income and your lifestyle can also trigger scrutiny. Make sure your tax returns accurately reflect your financial situation. If you’re unsure about any aspect of filing, consult with a tax professional. Professional guidance can help you navigate complex tax laws and avoid potential problems.