Creating a professional invoice is crucial for any business, large or small. A well-crafted invoice not only ensures you get paid promptly but also reflects the professionalism and credibility of your business. This comprehensive guide will walk you through the essential elements of a professional invoice, providing you with the knowledge and tools to create invoices that make a positive impact on your clients and improve your business finances. Learn how to structure your invoices effectively, include all necessary information, and present a polished image that reinforces your brand. Whether you’re just starting out or looking to refine your existing invoicing process, this guide offers invaluable insights to help you master the art of creating professional invoices.

From understanding the key components of an invoice, such as invoice numbers, payment terms, and accurate item descriptions, to exploring different invoice formats and software options, this article covers it all. Discover best practices for invoice customization to match your brand identity and explore strategies for sending and tracking your invoices efficiently. By implementing the tips and techniques outlined here, you can streamline your invoicing process, enhance your professional image, and ensure timely payments for your goods and services. Mastering the art of the professional invoice is an essential step towards building a successful and financially sound business.

Why a Professional Invoice Matters

A professional invoice is crucial for several reasons. It reflects credibility and professionalism, making a positive impression on clients. A well-structured invoice clearly outlines the services rendered and associated costs, minimizing confusion and potential disputes.

Furthermore, professional invoices facilitate timely payments. Clear payment terms and instructions encourage clients to pay promptly. They also simplify bookkeeping and accounting processes for both you and your client, making tax season less stressful.

Finally, a professional invoice serves as a legal document, providing a record of the transaction in case of any discrepancies or legal issues. It protects both parties involved and ensures clarity regarding the agreement.

Essential Elements to Include

A professional invoice must include several key elements to ensure clarity and proper payment processing. Your business’s name, address, and contact information should be clearly displayed at the top. Likewise, ensure the client’s name and address are accurate.

A unique invoice number is crucial for tracking and record-keeping. Clearly list the date of issue and the due date for payment. Itemize the products or services provided, including a brief description, quantity, and unit price.

Calculate the total amount due, including any applicable taxes or discounts. Specify accepted payment methods and provide clear instructions for remitting payment.

Numbering and Organization Systems

A consistent and logical invoice numbering system is crucial for efficient record keeping and tracking. Choose a system that works for your business, whether it’s sequential numbering (e.g., 001, 002, 003), date-based numbering (e.g., 20240101-001), or a combination of both. Maintain a record of all issued invoice numbers to prevent duplicates and ensure accurate financial reporting.

Organize your invoices chronologically and store them securely, whether digitally or physically. This organized approach simplifies retrieval for audits, tax purposes, or client inquiries. Consider using accounting software that automates invoice numbering and organization.

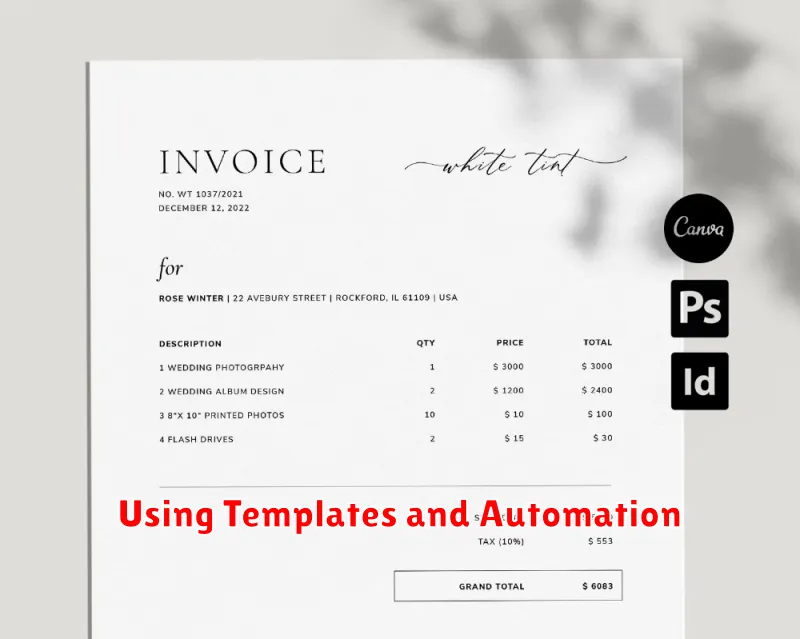

Using Templates and Automation

Leveraging templates and automation significantly streamlines the invoicing process. Pre-designed templates ensure consistency and professionalism, incorporating your business branding and necessary information automatically. This reduces the risk of errors and saves valuable time.

Many accounting software solutions offer customizable invoice templates. You can also find free or paid templates online, compatible with various spreadsheet and word processing programs. These templates often include pre-filled sections for common invoice elements like descriptions, quantities, unit prices, and tax calculations.

Automation takes this efficiency a step further. Features like automatic invoice numbering, recurring invoices, and automatic payment reminders drastically reduce manual data entry and follow-up, allowing you to focus on other essential business tasks.

Terms and Conditions Clarity

Clearly defined terms and conditions are crucial for a professional invoice. They prevent misunderstandings and protect both you and your client. Outline payment terms, late payment fees, and accepted payment methods.

Specify the due date for payment. Common terms include Net 30, Net 60, or payment upon receipt. Be explicit about any penalties for late payments, such as a percentage-based late fee. This ensures timely payment and establishes professional expectations.

Due Dates and Payment Methods

Clearly stating payment terms is crucial for timely payments. Specify a due date, such as “Net 30” (payment due within 30 days of invoice date), or a specific calendar date. This helps clients understand their payment obligations and avoids confusion.

Offering multiple payment methods provides convenience for your clients and can encourage faster payment. Common options include:

- Check

- Credit Card

- Bank Transfer (ACH)

- Online Payment Platforms

Clearly list the accepted payment methods on your invoice to ensure a smooth transaction. Ensure your chosen methods align with your business operations and client preferences.

Tracking Paid and Unpaid Invoices

Effectively tracking invoices is crucial for maintaining healthy cash flow. A well-organized system allows you to quickly identify outstanding payments and follow up as needed. This minimizes late payments and ensures you have a clear picture of your business’s financial health.

Several methods exist for tracking invoices. Using spreadsheet software is a common approach. Create columns for invoice number, date, client name, amount due, due date, and payment status. Consistently updating this sheet provides a readily available overview of your invoices.

Dedicated accounting software offers more advanced features like automated reminders and reporting. These programs can streamline your invoicing process and save you valuable time.

Regardless of your chosen method, diligence and organization are key. Regularly reviewing your invoices and promptly following up on overdue payments will significantly improve your cash flow management.

Following Up on Overdue Payments

Following up on overdue invoices requires a professional and persistent approach. Begin by sending a gentle reminder shortly after the due date. This could be a brief email or a phone call.

If the payment remains outstanding, escalate your efforts. Send a formal follow-up letter outlining the overdue amount and the consequences of non-payment. Clearly state any late payment fees or potential legal action.

Maintain detailed records of all communication and payment attempts. This documentation will be crucial if you need to involve a collections agency or pursue legal action.

Using Online Invoicing Tools

Online invoicing tools simplify the process of creating, sending, and managing invoices, offering a more efficient alternative to manual methods. These tools often provide pre-designed templates that ensure a professional look and incorporate all the necessary elements of a proper invoice.

Many online invoicing services offer features like automated payment reminders, which reduce the need for manual follow-up. They also facilitate online payments, allowing clients to pay invoices quickly and conveniently through various methods. This can significantly improve cash flow for your business.

Furthermore, these tools often include reporting and analytics features. These reports can provide valuable insights into your invoicing and payment patterns, helping you identify trends and make informed business decisions.

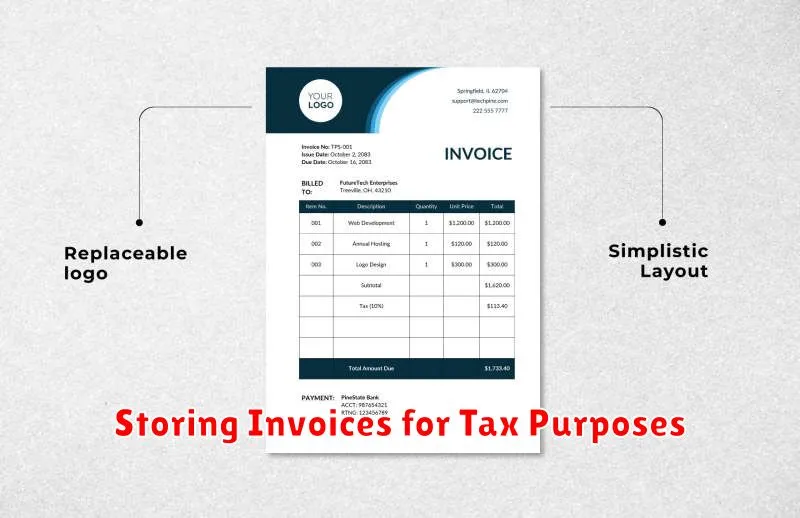

Storing Invoices for Tax Purposes

Proper invoice storage is crucial for tax compliance. Organized records simplify tax preparation and facilitate accurate reporting. The Internal Revenue Service (IRS) requires businesses to keep records that support the information reported on their tax returns.

Maintain both sent and received invoices. Sent invoices document your income, while received invoices substantiate your business expenses. These records are essential for supporting deductions and claiming credits.

Recommended storage methods include digital copies saved securely on a hard drive or cloud storage, and physical copies filed in a chronological and easily retrievable system.